Table of Contents[Hide][Show]

The excel min function is used to return the smallest numerical value in a range of cells. If the cells in the range contain empty cells, text values and logical values True or False, they are ignored by the MIN function. In this post, we would take you through all you need to know about the MIN function and how to apply this in a real-life modeling situation. let's introduce you to the Syntax

Syntax & Argument

The syntax of the excel MIN function is:

=MIN(number1, [number 2], ...)

The MIN function can take as many as 255 arguments. These arguments refer to cells containing numerical values. The number1 can refer to a single cell containing a numerical value or to a range of cells containing numerical values, so also can the number2 in the syntax above.

Let's look at some examples on the MIN function below:

MIN Function Excel Examples

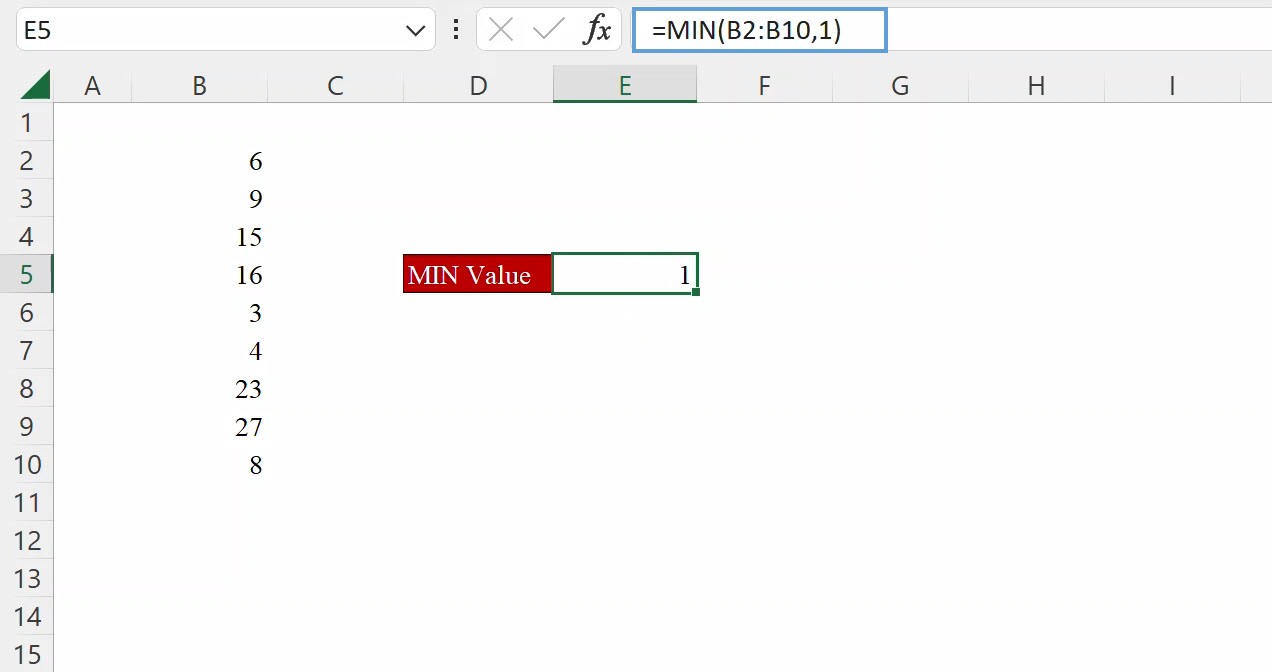

The MIN function would return the smallest value from a group of hardcoded numbers, cells containing numbers or a combination of both.

When used on a range, it returns the lowest value within the range

The MIN function can be used on a mix of hardcoded numbers and cell referenced arguments

Practical Use of MIN Function in Financial Modeling

In financial modelling for startup, there is a term called peak funding, this refers to the total funding requirement needed to sustain the business until it becomes self-funding. During fund raising for the startup, founders are looking to raise a minimum of their peak funding requirement. How do they calculate their peak funding requirement? Startups or any existing business usually prepares a business plan which could span 5 or 10 years depending on the management's directive.

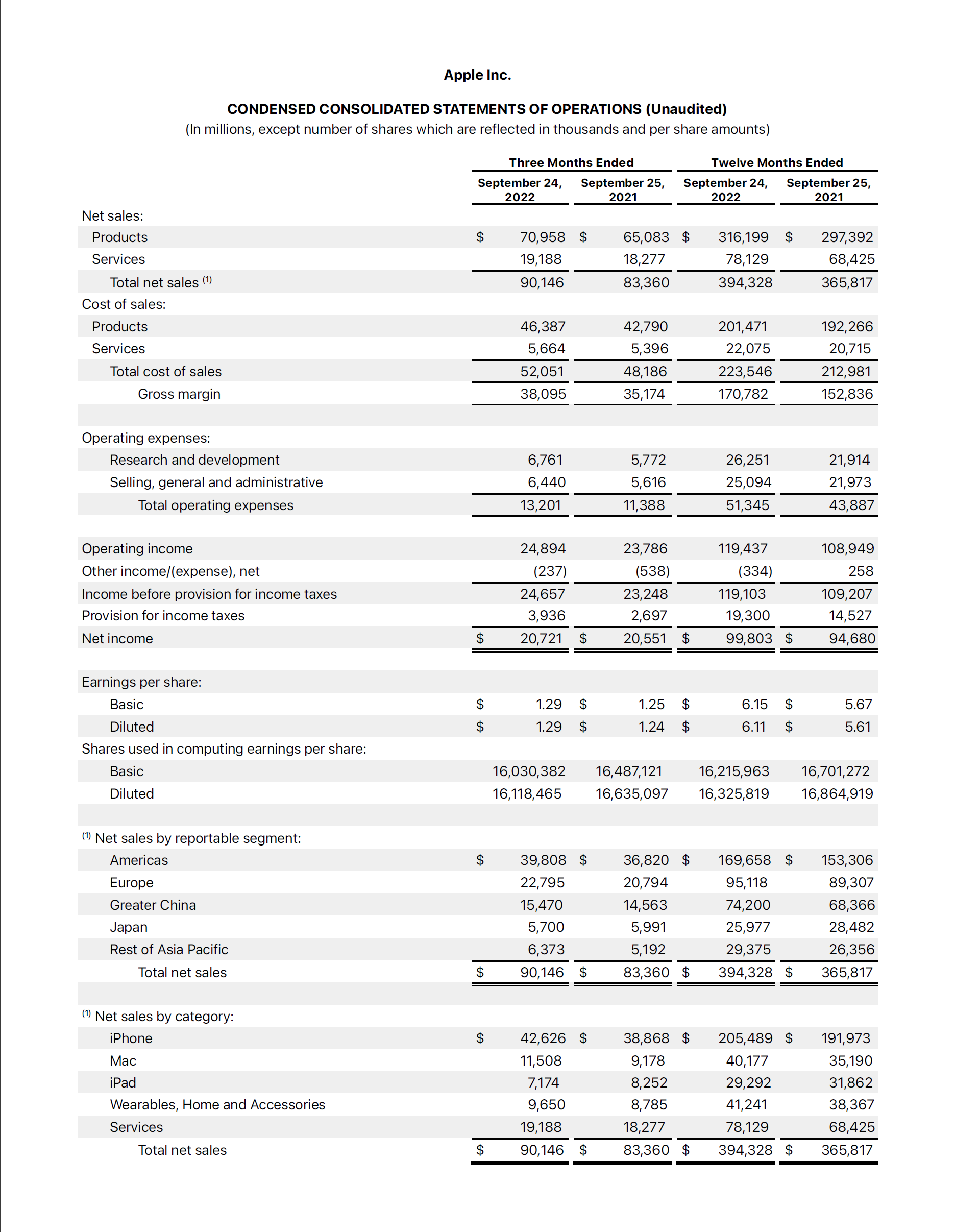

The business plan is a modelling of the 3 statement financials (Income Statement, Balance sheet or statement of financial position and the cashflow statement). These plans take into consideration the current revenue generating capacity of the company, Capital Expenditures needed and how they affect the revenue generating capacity of the company, variable expenses (direct / variable costs) and fixed / operating expenses (selling & distribution, administrative, general expenses). Finally, we provide for below EBITDA items like Depreciation & Amortization, Interest expenses and Taxes.

When we combine the above (excluding Depreciation & Amortization) in our cashflow statement, we are able to arrive at our cash balance for each period and the lowest negative cash balance becomes the peak funding requirement of the business. If the business is lucky enough to have positive cash balance in every period, then there is no funding requirement except of course the company is planning an expansion or Investment which hasn't been captured in the business plan.

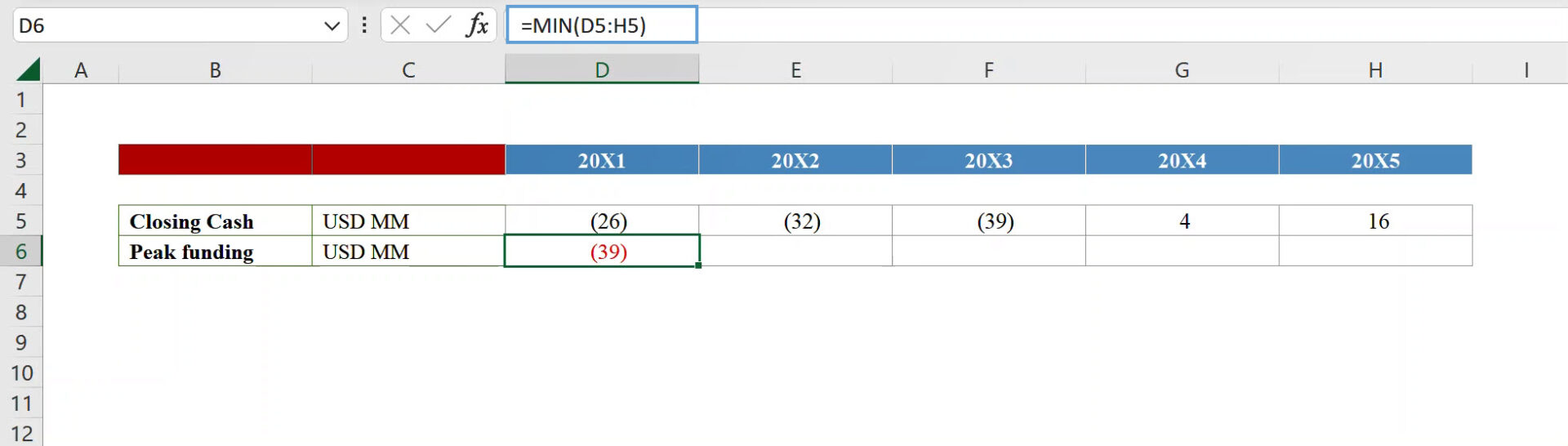

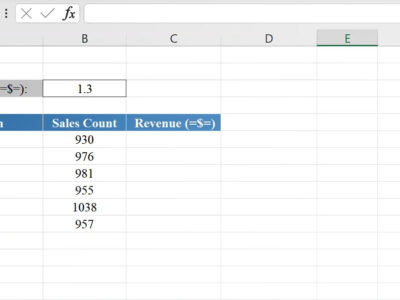

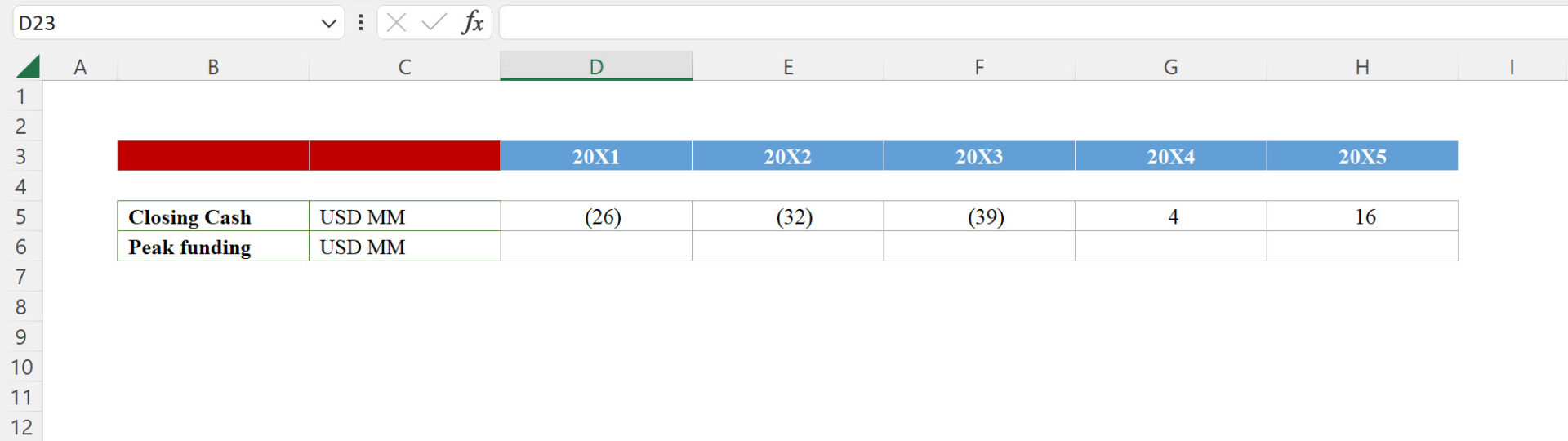

In our example for this section, we have the closing cash value for a 5-year business plan and we need to calculate the peak funding requirement:

To calculate the peak funding requirement, simply use the MIN function below: